Services Rendered in Connection with the Use or Installation or Operation of. Non-Exempt Domestic Corporations - 5000.

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

10 December 2019 Page 4 of 42 The fees of RM2 85714 is subject to a withholding tax of 10 under section 109B of the ITA.

. Failure without reasonable excuse to furnish an Income Tax Return Form give notice of chargeability to tax. For help with your withholding you may use the Tax Withholding Estimator. For apportionment purposes New Jersey uses a single-sales.

The fees of RM285714 is subject to a withholding tax of 10 under section 109B of the ITA. Withholding tax rate of 10 is only applicable for interest payment paid or incurred by an enterprise in an industrial undertaking. Details of 2 Agent Commission Withholding Tax.

03-8911 1000 call within Malaysia or 603-8911 1100 call from oversea Fax number. New York City. Withholding tax rates are 10 3 The 10 is in respect of the tax liabilities of the non-resident contractor while the 3 is for the tax liabilities of the employees of the non-resident contractor.

The dam will take 1 year to be built. A fine up to RM10000 200 of tax undercharged. The amount you earn.

This amount has to be paid to LHDN. For employees withholding is the amount of federal income tax withheld from your paycheck. The information you give your employer on Form W4.

Withholding tax on services is exempted under Income Tax Exemption No9 Order 2017. For information on taxes or sewer billings please contact the Tax Collection Office at 732 562-2331. Taxpayer will have to call the stated IRBM phone number to get the complete payment procedure for tax payment via telegraphic transfer.

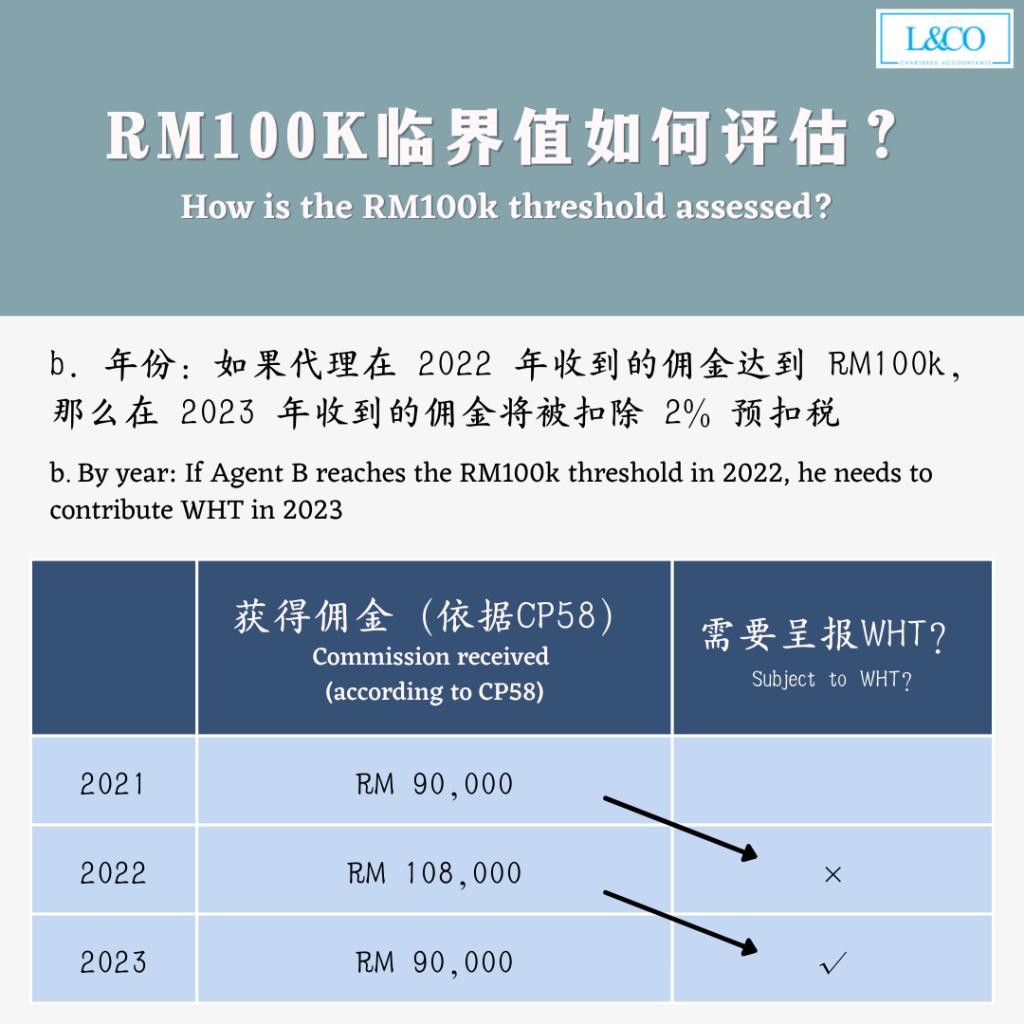

Damit Pty Ltd an Australian company is engaged by MM Sdn Bhd to build a dam in Ulu Langat Selangor. A 2 Withholding Tax WHT will be imposed to agents dealers or distributors whose commission exceed RM100k within 1 year. Anyone earning above RM34000 before EPF deductions for this period needs to submit a tax return to LHDN.

In simpler terms if you are paying non-local foreign vendors you need to withhold a certain of the invoiced amount and pay to LHDN as a form of tax and the remaining balance. LEMBAGA HASIL DALAM NEGERI MALAYSIA. According to the latest FAQ the company has to declare Form CP107D to LHDN and agents must have a tax number.

INLAND REVENUE BOARD OF MALAYSIA. WITHHOLDING TAX ON SPECIAL CLASSESS OF INCOME Public Ruling No. Penalty Provisions Hefty fines and imprisonment can be levied against those who fail to file.

15 hours agoThe 2 withholding tax for 2022 applies to ADDs which have received more than RM100000 in monetary andor non-monetary form in 2021 from the company making the payments. Eighth-monthly monthly or quarterly. Payment of any outstanding taxes must be made at the same time.

LHDNM - Implementation of 2 Withholding Tax Deduction Under Budget 2022 On 12 January 2022 Lembaga Hasil Dalam Negeri LHDNM issued a Media Release on the implementation of a 2 withholding tax on payments by a paying company to agents distributors and dealers that are resident individuals who received RM100000 or more in monetary and non. All persons having the control receipt custody disposal or payment of certain items of that income are withholding agents and are required to. Seksyen 109 Akta Cukai Pendapatan 1967.

Sources shown in the preceding table. The withholding tax in Malaysia is an amount withheld by the party making payment payer on income earned by a non-resident payee. The amount of income tax your employer withholds from your regular pay depends on two things.

A fine up to RM20000 Imprisonment not exceeding 6 months Both. LHDN said the company making the payments must submit Form CP107D Pin 22022 in PDF form and Appendix CP107D2 in Excel format via email to the payment centres. Company X would be required to remit to New Jersey a withholding tax on behalf of A for A s 20 share of Company X s income including Company Y s 2016 operational income and the income from the sale of Company Y s assets apportioned to New Jersey NJ.

Introduction - What is Withholding Tax. I There is no withholding tax on dividends paid by Malaysia companies. This form can be downloaded and submitted to Lembaga Hasil Dalam Negeri Malaysia For taxpayers that have the digital certificates for individual files SG or OG or the digital certificates for company files OeF-file C they can now pay withholding taxes under form CP37A electronically to IRBM via e-WHT.

Withholding tax is an amount withheld by the. If you have too little federal tax withheld from your pay you could. The 2022 Delaware Relief Rebate Program was created by House Bill 360.

Headquarters of Inland Revenue Board Of Malaysia. 5 rows 16 hours agoThis two per cent withholding tax for 2022 applies to ADDs who have received more than RM100000. 70 SCOPE OF TAX LIABILITY FOR ROYALTY 71 Any royalty paid to a non-resident in relation to e-CT will be subjected to withholding tax under section 109 ITA 1967.

The Tax Collectors office is responsible for collecting taxes for the Township of Piscataway Middlesex County the Piscataway School Board and the Piscataway fire districts. Section 109 Income Tax Act 1967. 72 Effective from YA 2017 the definition of Royalty has been amended where.

Payments made to non-residents in respect of the provision of any advice assistance or services performed in Malaysia and rental of movable properties are subject to a 10 WHT unless exempted under statutory provisions for purpose of granting incentives. IRS Withholding Calculator Can Help Figure Your Tax. 102019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

Posted Tue Jul 19 2011 at 1257 am ET. In addition to the 10 penalty the company will not be allowed to claim a tax deduction on the amount paid to that individual unless the payment of withholding tax and the late payment penalty have been paid. The deadline for tax returns for salaried individuals those who dont run a business is 31st March.

In Delaware there are three possible payment schedules for withholding taxes. Make an incorrect tax return by omitting understating any income. In addition this department collects annual sewer fees.

Calculation Of Withholding Taxes Or Payroll Taxes In Delaware. Besides LHDN has deferred the remittance of WHT until 31032022. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba.

871 a and 881 a impose a tax of 30 of the fixed and determinable annual or periodical FDAP income received from sources within the United States by a nonresident alien. Services Rendered in Connection with the Use or Installation or Operation of Assets Paragraph 4Ai of the ITA 61 Paragraph 4Ai of the ITA consists of amounts paid in consideration of services which are performed in or outside Malaysia rendered. If the company fails to deduct and remit the withholding tax to LHDN a penalty of 10 will be imposed on the unpaid tax.

Public Bank Berhad Lhdn Income Tax And Pcb Payment

Lhdn 2 代理佣金预扣税 Withholding Tax 最新更新 L Co

2 Withholding Tax On Commission Dec 30 2021 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

Anas Sazali Cara Bayar Withholding Tax Wht Utk Fb Dan Facebook

Details Of 2 Agent Commission Withholding Tax L Co

How The Finance Bill 2021 Affects Your Commission

Types Of Taxes In Malaysia For Companies

How To Pay Withholding Tax Can Withholding Tax Pay By Online

Ctos Lhdn E Filing Guide For Clueless Employees

Withholding Tax On Payments To Resident Individuals Must Be Remitted By End Of Following Month Selangor Journal

Withholding Tax Payment Guide At Lhdn Em Han Associates Facebook

Withholding Tax On Special Classes Of Income Chartered Tax

Anas Sazali Cara Bayar Withholding Tax Wht Utk Fb Dan Facebook

Details Of 2 Agent Commission Withholding Tax L Co

How To Pay Withholding Tax Updated May 2022 Treey Consultancy

Details Of 2 Agent Commission Withholding Tax L Co

Details Of 2 Agent Commission Withholding Tax L Co